Your cart is currently empty!

Self-Pay Strategy Assessment

💲 Price: $1,500 (one-time)

Overview

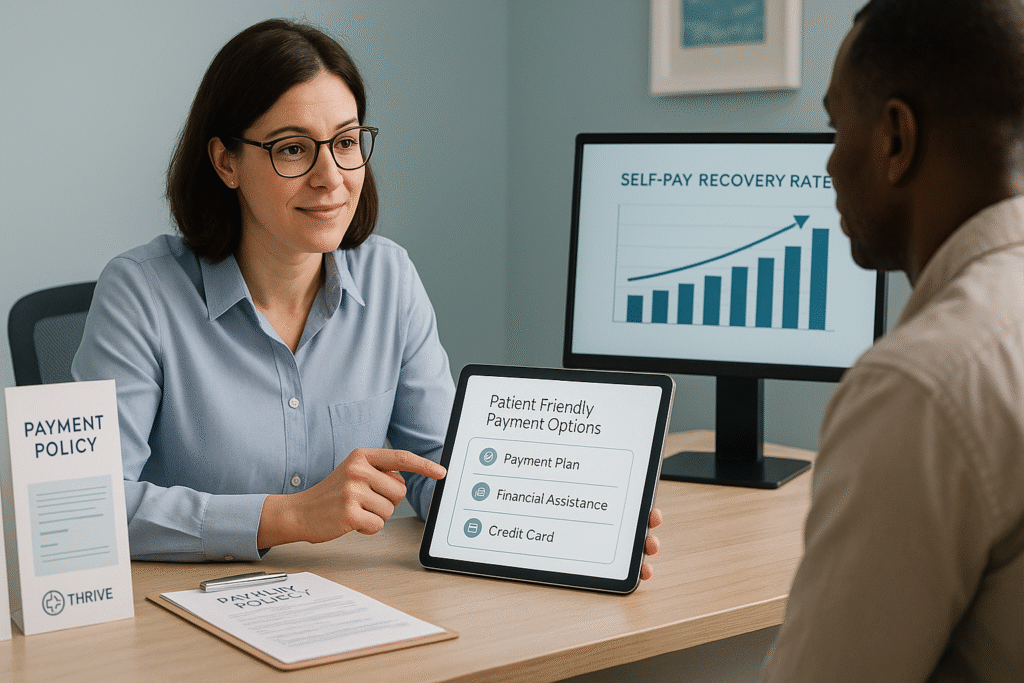

With patient responsibility now accounting for nearly 30% of provider revenue, your self-pay processes are more important than ever. Thrive’s Self-Pay Strategy Assessment helps you evaluate and improve how your organization communicates, collects, and follows up on patient balances—while maintaining trust and compliance.

This assessment is ideal for clinics experiencing rising bad debt, patient complaints about billing, or collections that lag behind industry benchmarks.

What’s Included

- Analysis of current patient financial policies, estimate workflows, and statement cycles

- Review of payment plans, upfront collections, charity care, and financial assistance procedures

- Comparison of your self-pay performance to industry best practices

- Recommendations to improve collections while protecting patient satisfaction

- Written Self-Pay Optimization Report with suggested workflows, scripts, and segmentation strategies (e.g. by balance, timing, patient type)

How It Works

- After purchase, you receive a secure onboarding form to submit your policies, templates, and performance reports (e.g., days to payment, % collected).

- Thrive conducts a 360° review of your self-pay lifecycle—from pre-service estimates to final balance resolution.

- You receive a PDF report outlining quick wins, medium-term opportunities, and long-term structural recommendations.

- Optional follow-up call is available to walk through strategies with your leadership or billing staff.

ROI & Benefits

- Increase patient collections and reduce bad debt

- Improve transparency and financial communication

- Implement smarter segmentation (e.g. offer payment plans earlier)

- Train staff on empathetic but effective scripting

- Position your practice to handle higher deductibles and shifting payer mixes

Timeline & Delivery

- Turnaround: 10 business days

- Delivery: Secure PDF report

- Optional 30-minute call included

Compliance Note

This assessment aligns with CMS and HFMA guidelines for patient financial communications. Thrive ensures HIPAA-compliant handling of all documents and signs a BAA with every client.