It’s easy to chalk up patient balances to bad debt and move on—but doing so quietly drains long-term revenue and damages patient trust. The real issue isn’t patients refusing to pay; it’s the systemic breakdowns in communication, timing, and expectation-setting that make payment unlikely from the start.

As high-deductible plans continue to rise and patients shoulder more of the financial burden, revenue cycle leaders must shift their strategy from reactive write-offs to proactive prevention.

Why Patient Bad Debt Is More Preventable Than You Think:

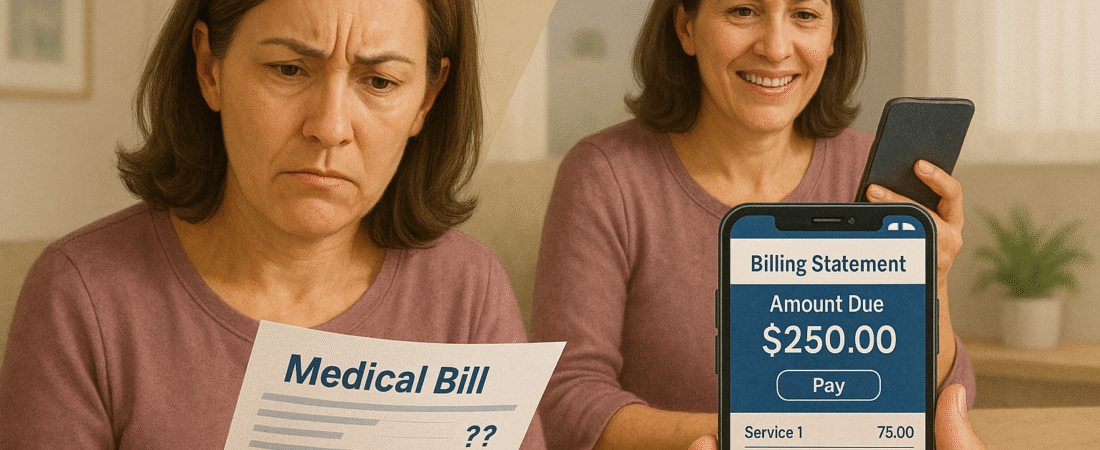

Most uncollected patient balances don’t begin as unwillingness—they start as confusion. Patients are often unclear about what they owe, when it’s due, or why they’re being billed at all. If the first explanation comes in a collections letter, the opportunity for successful engagement has already passed.

Common contributing factors include:

- Unclear upfront estimates: Many organizations still provide generic “it depends” answers at registration.

- Delayed statements: By the time the bill arrives, the visit is a distant memory—and the budget is already spent.

- Inflexible payment options: Requiring full payment upfront or in one lump sum excludes many patients.

- No follow-up cadence: After a single statement, many practices don’t send reminders—especially digitally.

Rethinking Patient Financial Engagement:

Preventing bad debt starts long before the first statement. Leading organizations are shifting from a collections mindset to a financial experience mindset that treats patients as informed participants—not passive recipients.

Here’s how:

- Provide accurate estimates before the visit, not just disclaimers.

- Offer multiple payment options at every step, including mobile, auto-draft, and payment plans.

- Automate gentle reminders via SMS and email with simple links to pay.

- Train front desk and billing staff to have transparent, empathetic financial conversations—without awkwardness.

- Align billing cadence with patient expectations (e.g., first bill within 5–7 days of service, not 30+).

How Thrive Helps Patients Say “Yes” to Paying Sooner:

Thrive Revenue Cycle partners with practices to reduce avoidable patient bad debt by redesigning the entire front-to-back financial journey. From scripting pre-visit financial discussions to deploying digital payment reminder workflows, we help providers balance empathy with efficiency. With Thrive’s support, clients have increased patient collections by up to 25%—without increasing outbound calls or sending accounts to collections agencies.

Conclusion:

Writing off patient balances should be a last resort—not a routine line item. With the right structure, messaging, and follow-up, most patients will pay what they owe—especially when they understand why. And in today’s healthcare economy, that’s not just good business—it’s essential.