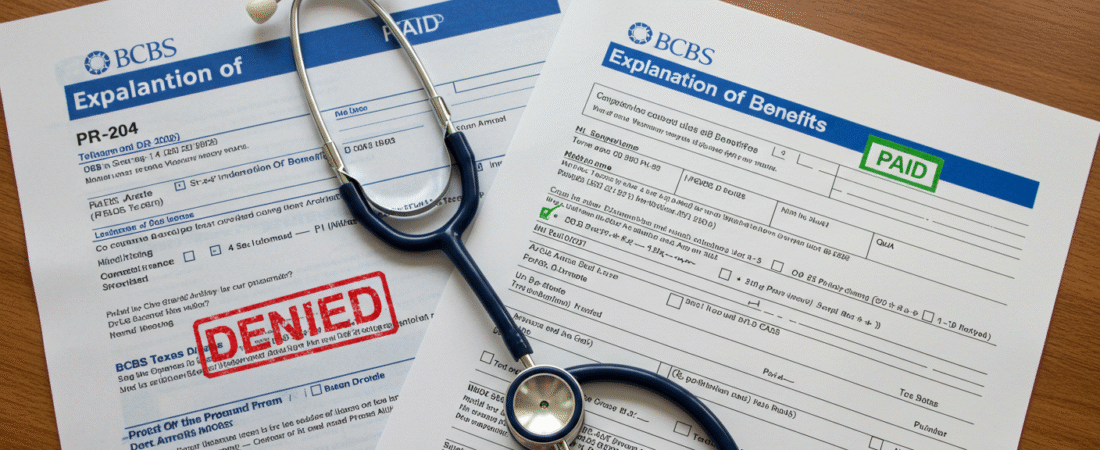

Every week, providers across the country are blindsided by unexpected denials from Blue Cross Blue Shield (BCBS)—even when they believe they’re in-network. The confusion often stems from out-of-state BCBS plans that follow different processing rules, network tiers, and policy-level restrictions.

In 2023, out-of-network-related denials jumped by over 18%, especially for specialty clinics serving traveling patients, snowbirds, college students, or families on national employer-sponsored plans. Without a clear grasp of BCBS’s BlueCard® program and policy-specific verification, practices risk:

- CO-18 denials (duplicate or invalid payer)

- PR-204 denials (services not covered out-of-network)

- Increased days in A/R and lost revenue

This blog unpacks how BCBS out-of-state processing works, what “in-network” really means with Blue plans, and how you can protect your clean claims rate with smarter front-end workflows.

Why Denial Management Must Account for “In-Network, But Not Really”

As of 2025, Blue Cross Blue Shield covers over 115 million members nationwide through 34 independent companies (e.g., BCBS Illinois, Anthem BCBS, Horizon BCBSNJ). While the BlueCard® program allows patients to use their home plan across state lines, each plan has its own network structure, reimbursement rates, and claim routing rules.

Just because your clinic is in-network with “BCBS” in your state does not guarantee you’re in-network with a member’s specific plan from another state.

1. Understand the BlueCard® Program Workflow

Denial Type: CO-18 or CO-109 – Claim not routed to correct payer or processed incorrectly

Why It Happens: Claims are routed to the wrong BCBS plan, or the billing office is unaware of how the member’s plan requires processing.

Key Concepts:

- Home Plan: Where the member’s policy originates (e.g., BCBS of Texas)

- Host Plan: The BCBS plan in your state where services are rendered (e.g., BCBS Minnesota)

- Prefix: The first 3 characters of the member ID are critical in routing and verifying eligibility

Implementation Tips:

- Use the alpha prefix to route eligibility, benefits, and claims to the right Home Plan

- Always submit claims to your local BCBS plan, who will forward it to the Home Plan

- Watch for letters of agreement or plan-specific reimbursement rules tied to national accounts

Quick Win: Post a reference sheet of BlueCard® alpha prefixes and their originating plans at all registration desks.

2. Verify Each Policy for Network Tier Status

Denial Type: PR-204 – Services not covered because provider is out-of-network

Why It Happens: Providers assume “BCBS” = “in-network,” but many BCBS plans have tiered networks or exclusive provider organizations (EPOs) that restrict coverage.

Examples:

- A Minnesota OB/GYN in-network with BCBS MN may not be considered in-network by BCBS Illinois Blue Choice PPO.

- Anthem BCBS members may have EPO plans that do not cover any out-of-network services unless it’s an emergency.

Implementation Tips:

- Ask payers “Is this provider in-network for this specific plan?”—not just “Do you accept BCBS?”

- Confirm network participation via payer portals or BlueCard Eligibility line

- Capture plan type (e.g., PPO, HMO, EPO) and tier status in the patient account

Quick Win: Create dropdown fields in your PMS to record plan type and tier status for all BCBS out-of-state plans.

3. Use Real-Time Eligibility Tools with BlueCard Integration

Denial Type: CO-27 – Coverage not in effect or invalid ID

Why It Happens: Out-of-state BCBS policies often return incomplete or outdated information if not verified using the correct payer system.

Implementation Tips:

- Use clearinghouses or tools that support real-time eligibility checks through the BlueCard® gateway

- Confirm coverage start/end dates, deductible status, authorization requirements, and network limitations

- Document the reference number and rep’s name for any phone calls made during verification

Quick Win: Set your eligibility software to flag any BCBS plan where the alpha prefix does not match your local BCBS.

4. Educate Front Desk and Billing Staff on BCBS Plan Variability

Denial Type: CO-96 – Non-covered charges; CO-45 – Charge exceeds fee schedule

Why It Happens: Staff assumes all BCBS plans reimburse similarly or follow the same EDI workflows.

Implementation Tips:

- Train staff to recognize high-risk plans (e.g., Anthem Pathway, FEP, Blue Advantage)

- Create BCBS payer grids by common out-of-state payers with documentation rules, pre-auth links, and contact numbers

- Host quarterly payer training refreshers with examples of out-of-state claim pitfalls

Quick Win: Add “Plan Type” and “Is Thrive In-Network for This Plan?” fields to your intake form or digital pre-registration tool.

5. Track Denials by Prefix and Plan to Spot Trends

Denial Type: All

Why It Matters: Not all out-of-state BCBS plans perform equally—some are frequent sources of denials due to plan design, communication issues, or low negotiated rates.

Implementation Tips:

- Segment BCBS denials by alpha prefix, state, and denial reason

- Identify which plans require pre-authorization, referrals, or special routing

- Analyze denial overturn rates and reimbursement lags by Home Plan

Quick Win: Add a “Top 10 BCBS Prefix Denials” report to your monthly RCM dashboard to target high-risk plans.

📍 Case Study: How One Clinic Recovered $46K from Out-of-State BCBS Denials

A physical therapy clinic in Wisconsin noticed a pattern of denied E/M and therapy claims from patients with BCBS plans out of New Jersey and Illinois. The denials cited out-of-network status and invalid member ID submissions.

After a Thrive Revenue Cycle audit:

- The intake team was retrained to verify all out-of-state BCBS plans using prefix-based payer lookup

- The billing team began tracking denials by alpha prefix and created custom rules in the EHR

- A 2-step verification process was added for any EPO or limited-network plans

Results within 90 days:

- Denial rate from BCBS out-of-state plans dropped by 63%

- The clinic recovered $46,000 in overturned claims

- Clean claim rate for out-of-state visits improved to 92.4%

Take the Guesswork Out of BCBS Out-of-State Claims

At Thrive Revenue Cycle, we know that navigating BCBS out-of-state processing isn’t easy—but it’s manageable with the right strategy. From eligibility training and payer grid setup to clean claim workflow design, we help clinics reduce preventable denials and get paid faster.

👉 Schedule your free BCBS denial audit today

Optimize. Accelerate. Thrive.