The Day the Cash Flow Slowed to a Crawl

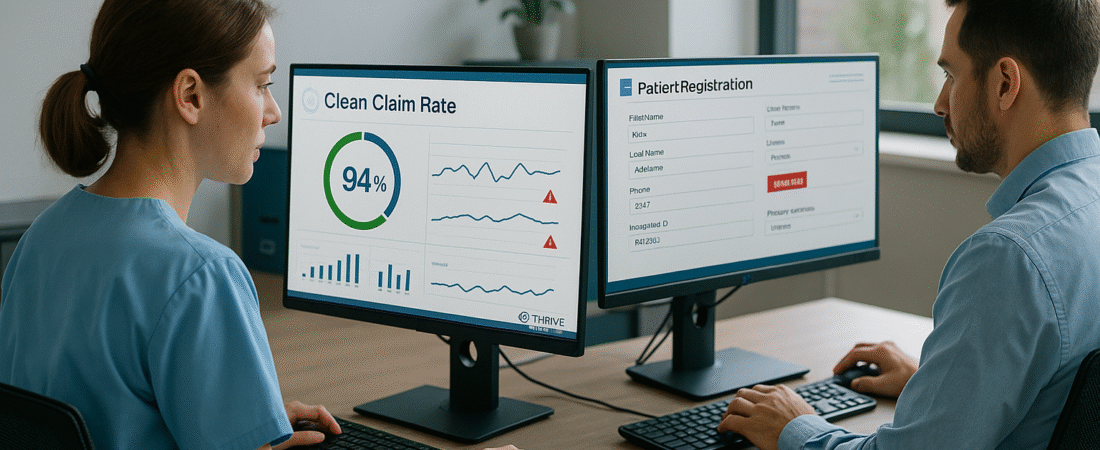

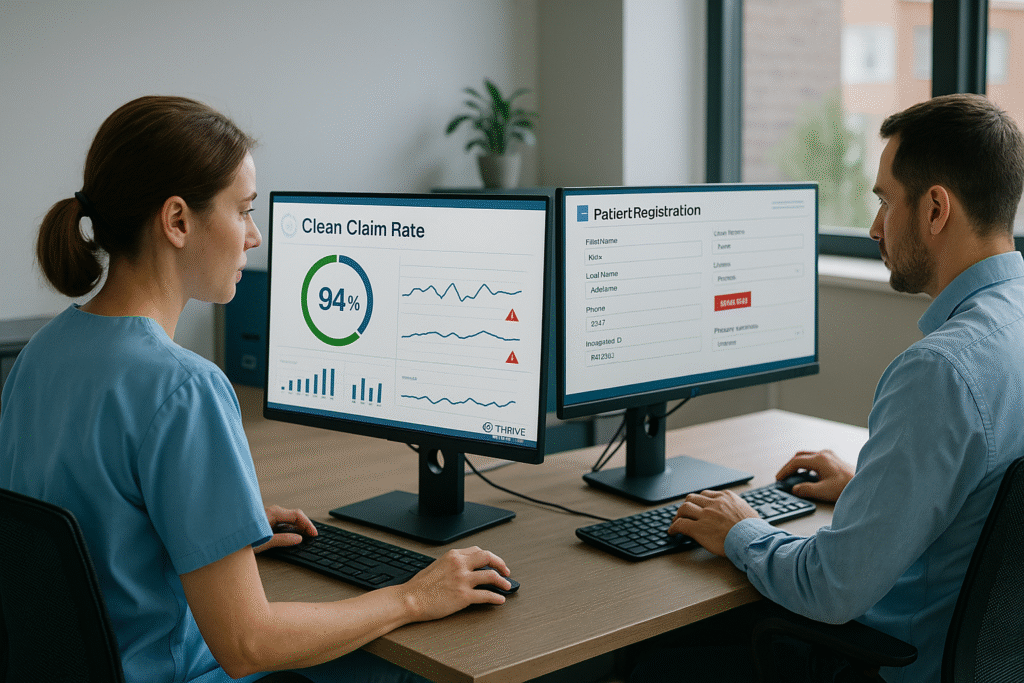

Last summer, Maria, the practice manager of a busy rural cardiology clinic, was feeling confident. The team had just hit a 94% clean-claim submission rate—a figure that meant faster payments and fewer headaches. But by October, things had changed. Reimbursement timelines were stretching, denials were piling up, and A/R days had jumped by 12. On paper, nothing had changed—yet the financial health of the practice was slipping.

Why “Almost Clean” Isn’t Good Enough

The reality for Maria—and countless clinics like hers—is that even small cracks in front-end processes can snowball into cash flow delays. A missing middle initial, a mismatched payer ID, or a single unchecked eligibility requirement can transform a “clean” claim into a costly rework. These errors often hide in plain sight, masked by otherwise strong performance metrics.

What makes these problems so dangerous is their stealth. The issue isn’t that teams aren’t trying—it’s that the source of the error is buried deep in everyday workflows, hard to detect until it’s too late. And by the time denials spike, the damage to revenue is already done.

The Root of the Problem: Invisible Front-End Weaknesses

Hidden clean-claim issues tend to come from three sources:

- Data Drift – Information like payer addresses, plan codes, or coverage details changes over time, and without real-time updates, even “correct” entries become outdated.

- Inconsistent Registration Practices – Different staff members collect different information or skip certain verifications under time pressure.

- Eligibility Overconfidence – Relying on a single eligibility check without cross-verifying against payer rules leads to avoidable rejections.

These root causes are rarely intentional—they’re the result of process gaps that only become visible with targeted analysis.

Finding and Fixing the Invisible

The most effective way to safeguard clean-claim rates isn’t just more training—it’s early detection.

Best Practices for Sustaining Clean Claims:

- Run a Front-End Audit Quarterly – Review recent claims for errors tied to registration and eligibility.

- Standardize Intake Workflows – Use a single, validated checklist for all staff to collect patient data.

- Dual Eligibility Verification – Cross-check eligibility through both the EMR integration and the payer portal for high-risk payers.

- Spot-Check Payer Edits – Identify recent payer rule changes that may have slipped past your normal workflows.

One of the most powerful tools Maria’s clinic used to recover was a The Intake Shield™ , which analyzed intake data, payer rules, and registration workflows. This process uncovered that 27% of the clinic’s “clean” claims had at least one data mismatch—not enough to flag upfront, but enough to trigger rejections after submission. Fixing those small errors brought their A/R days back down within a month.

Turning Clean Claims Into Cash—Every Time

For Maria, the difference between “clean enough” and “truly clean” was worth hundreds of thousands in recovered revenue over a year. The right audit revealed the hidden weak spots, equipped her staff with a standardized process, and stopped the slow leak in cash flow.

If you’re ready to uncover the invisible errors hiding in your workflows, our The Intake Shield™ can help. In just a few days, you’ll know exactly where your risks are—and have a clear plan to fix them—so your “clean” claims stay that way.